Breaking News

The Cayman Islands Customs and Border Control Service (CBC) is currently investigating a sailing vessel that arrived in Cayman Brac without clearance. The vessel is moored approximately 150 feet offshore. On board are three adult males, one adult female and a female infan...

Facts about the last multinational intervention sanctioned by the United Nations

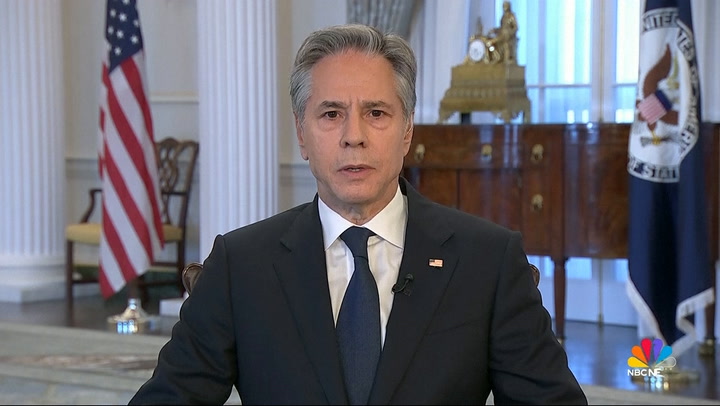

According to media reports, Cuba has been removed from the shortlist of countries designated by the United States as state sponsors of terrorism. The statement on Wednesday, May 15, 2024, coinci

"It's a new adventure for me, and I can't wait to see where it takes us..."

Sponsored ByiRock.bet

Cardiovascular disease (CVD) is known to be the leading cause of death worldwide. This remains true in Jamaica and other Caribbean countries. Additionally, there is a high prevalence of CVD

Sponsored ByLASCO LaSoy

'Twas the first official band launch for the 2023 Carnival season, and patrons and stakeholders alike were rearing to get on bad. Since Xodus Carnival and Bacchanal Jamaica dropped the plot twi

Sponsored ByCarib Beer

When it comes to friendships, you are always going to be closer to some people than others. While many friends may fall into the “casual acquaintance” category, a special few sit comfortably within yo

Sponsored ByCoca-Cola

Dart and Caymanian businessman Handel Whittaker today announced that they have reached an agreement that will see Whittaker revitalising the storied Royal Palms Beach Club on Seven Mile Beach. The

0°C

0°C

![[iStock:Kar-Tr]](https://loopnewslive.blob.core.windows.net/liveimage/sites/default/files/styles/popular_big/public/2022-07/9260a4829dedbb2a4b04119268d18754friends-friendship-istock.jpg)

Facebook

Facebook

Twitter

Twitter

Instagram

Instagram